In the UK’s March 2021 budget, Chancellor Rishi Sunak introduced the new ‘super-deduction’ tax break for businesses. In effect for two years between 1st April 2021 and 31st March 2023, this first-year capital allowance of 130% applies to new plant and machinery capital purchases*. Essentially, this will cut tax bills by 25p for every pound invested in new equipment and is estimated to be worth around £25 billion to UK companies over the two years.

The kind of assets which may qualify for the super-deduction include, but are not limited to:

More detail on the eligibility of different types of investments for different types of capital allowances is set in this document from the government.

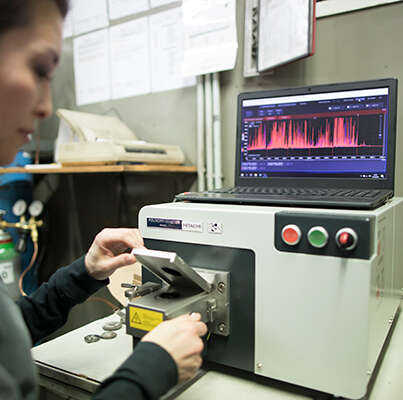

If you are a UK business that uses analytical equipment – either in-house or through an external testing company – and the super-deduction tax break applies to your company and capital asset purchase, then this could be a real opportunity to invest in LIBS, OES, XRF or TA equipment that extends your analytical capability.

There are many reasons why you might need to upgrade your analyzers or invest in an analyzer. Perhaps you are relying on third-party testing and would like to reduce testing costs and turnaround time? Have you recently had to switch material suppliers due to Covid19-related supply chain pressures? Or maybe new legislation or customer specifications mean that there is now a requirement to test your incoming material – only this week I talked to a customer who had issues with being supplied the wrong material, stainless steel 304 instead of stainless steel 316. Or it could be that your existing equipment is old and not performing as it should, or it is becoming increasingly expensive to maintain.

On a daily basis, I deal with companies that have invested in Hitachi analysis equipment for the above reasons, and they tell me the how investing in Hitachi analyzers has been a huge benefit for their business, saving in outsourcing testing and ensuring product quality is consistently high.

Find out more

If you need more analytical capability, now is the ideal time to start investigating your options. You’ll find information on LIBS, OES, XRF or TA analyzers here:

Handheld XRF and LIBS analyzers

Optical emission spectrometers

Benchtop XRF analyzers

Thermal analyzers

For product demonstrations and advice on the best analyzer for your industry and application, please get in touch, I’d be more than happy to talk you through your instrument options.

If you’d like to get in touch with me to discuss the different analytical options available, fill in our contact form or connect with me on LinkedIn.

About Dr Sarah Wright

Dr Sarah Wright joined Hitachi in 2018, helping to deliver analytical solutions to the UK and Ireland, providing expertise in handheld XRF, OES and benchtop XRF product ranges. She has a MSc in Geology and PhD in Geochemistry.

* Hitachi High-Tech Analytical Science doesn’t and can’t to provide tax advice to customers. Please make sure you get advice from your finance team or tax advisor to ensure you can benefit from this tax incentive.

You might also be interested in: